Monetizing APIs – One of SaaS’s biggest revenue opportunities

Monetizing APIs – One of SaaS’s biggest revenue opportunities

The API monetization platform market is projected to grow from $6.1 billion in 2023 to over $72.6 billion by 20233, a CAGR of 28.1%.¹

APIs are quietly becoming one of the biggest monetization opportunities in SaaS. While most companies focus on selling their core product, API-driven revenue is scaling fast—powering $100M+ businesses inside larger platforms. But pricing APIs remains tricky, balancing revenue potential with customer resistance.

The truth? Customers love integrations—but they often hate paying for them. We hear it all the time: “Why are we being charged for access to our own data?” or “This feels like nickel-and-diming.”

However, customers are willing to pay for a streamlined user experience, especially those who want custom solutions for their unique tech stack. Customer interviews we conduct often reveal that UI and usability are among the top five attributes in B2B SaaS vendor selection. Providing an integration that allows customers to work in their native environment significantly enhances their user experience. The challenge is that APIs create undeniable value—decreasing time to value, boosting retention, and making platforms stickier—yet pricing them the wrong way can trigger pushback.

At Monevate, we’ve helped multiple SaaS and DaaS companies navigate this exact challenge. Across all our clients, charging for APIs has sparked friction—internally and with customers—due to the complexities involved. Through these engagements, we’ve identified five common roadblocks in API pricing:

The 5 Big API Pricing Challenges

- Indirect Value Attribution: APIs often operate in the background and are not the explicit product customers are purchasing; they enable functionality but do not provide direct, visible value to end users. This makes it harder to quantify the value delivered to customers.

- Diversity of Use Cases: APIs are used in a variety of ways, from simple integrations to mission-critical workflows. A one-size-fits-all pricing model doesn’t work and creating a pricing model that captures the wide range of use cases is difficult to design. Even once designed, the complexity of identifying the specific use case and appropriately pricing customers can greatly slow deal velocity.

- Customer Perception of Fairness: Customers often find paying for APIs, especially multiple connections to the same data source, unacceptable and perceive per-integration charges as “nickel and diming”. Similarly, there is a question of fairness in charging for an API when the customer is already paying for the usage of data in a different way, such as through a usage metric.

- Choosing the Right Metric: Leaders often default to usage-based pricing (e.g., API calls, data processed), assuming it is the most value-aligned way to charge for APIs. However, a usage-based metric may not always correlate with the actual value delivered to customers. Additionally, usage-based metrics are difficult to forecast for both businesses and the customers, leading to unpredictability that can create friction in sales and adoption.

- Technical and Operational Costs: As high-volume customers scale, they may generate disproportionate infrastructure costs, especially for APIs with heavy data or CPU demands—potentially squeezing margins if pricing isn’t aligned. Sound familiar? This is the same cost challenge facing GenAI. Additionally, the costs to develop new APIs and maintain existing ones (e.g., documentation, SDKs, developer support) can be substantial, requiring careful financial planning.

How do you solve for this? The classic consulting answer—it depends.

Last year alone, I worked with three clients to tackle the same question: how should we price our APIs? Yet, each client required a unique approach, shaped by their specific factors, implications, and objectives. Together, these cases highlight key principles of API pricing.

Here is how we approached them:

Case #1: Overcoming the perception of ‘nickel-and-diming’

This cybersecurity client had $300M+ ARR and their API business generated more than a third of it. The success of their APIs stemmed from the fact that many of these APIs were truly “mission-critical”. This was a business where nearly every customer used at least one API, many customers relied on multiple, and APIs dramatically enhanced the value of the client’s core products.

However, their monetization strategy sparked controversy. Customers found their practice of charging for APIs unacceptable, often criticizing the practice as “nickel-and-diming.” Internally, the executive team worried that including integrations into core offerings would cannibalize revenue. Their challenge was clear: how to sustain ARR attribution to APIs while addressing mounting customer dissatisfaction and pushback.

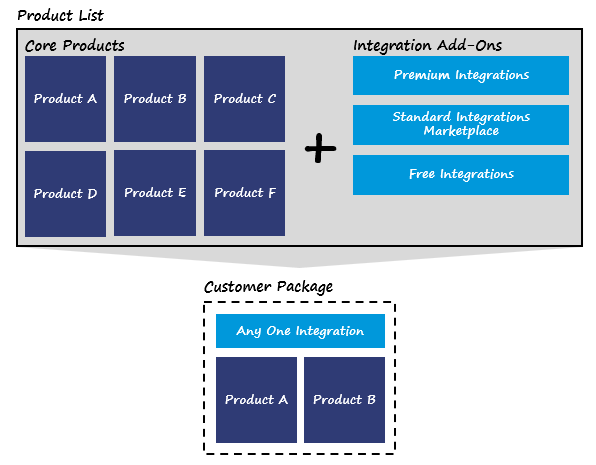

Solution: Instead of selling APIs separately, we restructured packaging to bundle one API integration with every purchase. To avoid cannibalizing ARR driven by APIs, we emphasized to the client that bundling an API with purchase is not equivalent to giving it away for free. Instead, the value of the API was embedded in the package price, and finance could continue to attribute ARR to APIs on the back end. However, from a marketing and positioning perspective, this shift resonated with customers, who responded positively to the perception that they were no longer being charged separately for API access.

For API power users, we introduced the option to purchase additional APIs a la carte. To create a clear value differentiation:

- Premium APIs, which delivered the highest level of value to customers and incurred direct costs for the client, were priced individually as a flat subscription fee.

- Standard APIs were bundled into a single marketplace, with access priced as a flab subscription fee.

- Low-value APIs were made free for all customers, enhancing goodwill and reducing friction in adoption

This approach ensured that APIs remained a strong revenue driver while improving customer perception, reducing sales friction, and minimizing down-sell risk. By aligning monetization with customer expectations, we preserved API-driven ARR while reinforcing the overall value of the product.

Case #2: Finding the right pricing metric to drive growth and profitability

This $25M+ ARR data cataloging company was growing rapidly, but solely through new customer acquisition—expansion revenue was stagnant. Their user-based pricing model, expected to drive YoY upsell, was backfiring—the average number of users was actually contracting YoY, leading to downsell instead. Meanwhile, APIs were sold as a flat-fee add-on, further limiting expansion ARR and NRR.

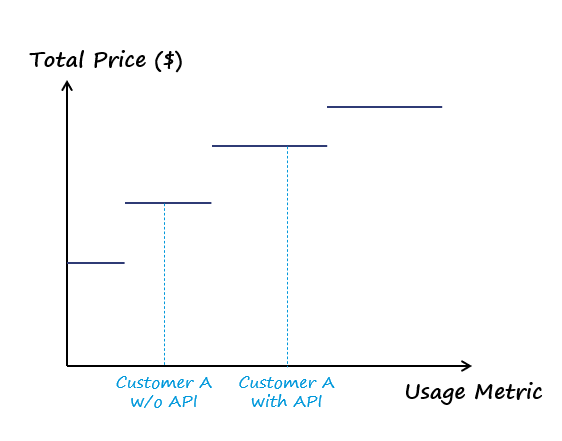

Solution: To unlock expansion revenue, we identified a usage metric that grows naturally YoY and shifted the business to usage-based pricing. This move created a win-win:

- For customers: As the API imported more data, the platform became more valuable—this also increased user engagement which was good for the client.

- For the client: The API could scale data input exponentially faster than manual imports, accelerating usage and expansion revenue faster.

To avoid double-dipping, we embedded the API’s value into the platform price rather than charging separately. This approach was acceptable to the client because, with the rise of gen-AI, the chosen usage metric was expected to grow exponentially— ensuring fair, long-term expansion revenue when priced appropriately.

Furthermore, a key concern was high API costs, with a few heavy-usage customers driving disproportionate expenses to the client without contributing proportional revenue. We solved this by implementing volume discounting—offering lower per unit prices at higher usage levels—while ensuring healthy margins at all levels. Unlike the previous flat-fee model, which failed to account for usage variation, this new model preserved profitability while meeting customer expectations.

This case highlights how the right pricing metric can fuel growth, enhance retention, and optimize profitability—all at once.

Case #3: Pricing beyond usage—aligning price with customer value

The final client discussed here, a $50M+ ARR consumer research data company, recently launched an API and was still figuring out how to monetize it effectively. The challenge? Two customers could use the same API to access the same data, but the value they derived varied drastically.

- For customer A, the API improves usability—a convenience. This customer calls the API hundreds of times a day to increase employee productivity.

- For customer B, the API generates revenue—a direct business driver. This customer only calls the API once a month but uses the data to develop a product sold to end customers.

While usage-based pricing is often the go-to solution for aligning price with value it didn’t work here. Objectively, Customer B receives significantly more value from the API despite a fraction of the usage. The real driver of value was each customer’s specific use case, which could be uncovered during the sales discovery process.

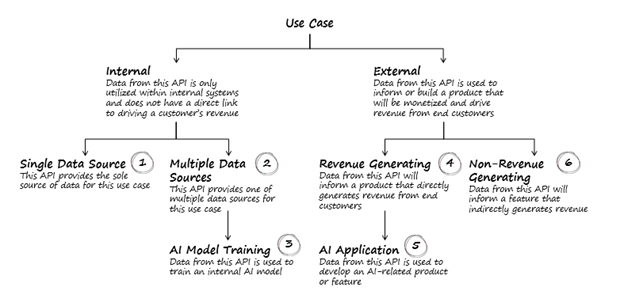

Solution: To identify a customer’s use case, we built a decision tree framework that bucketed customers into six distinct use cases, which helped identify willingness-to-pay (WTP) and ensure each customer would be adequately priced. We learned that the first and most critical distinction was whether the API would be used for internal or external use cases:

- An internal use case such as using the API to increase productivity (e.g., Customer A) makes the tool a cost to the business à the customer is expected to have lower WTP.

- An external use case such as using the API to develop a product (e.g., Customer B) is expected to generate revenue for the customer à the customer is expected to have a higher budget and WTP.

From there, additional criteria helped more granularly differentiate WTP and refine pricing further. Once a use case was determined, the customer was charged a flat fee for simplicity. While this framework worked for this client, your business may need different criteria to differentiate customers effectively.

This case highlights a key pricing lesson: aligning price with value isn’t always about usage—it’s about understanding how customers benefit from your product and how that impacts WTP.

3 Key Takeaways for API Pricing Success

It’s clear that successfully monetizing APIs requires a strategic approach that balances revenue generation and customer perception. Here are the three key takeaways to keep in mind:

- APIs drive significant value and should be positioned and monetized carefully—integrating API costs into platform pricing or offering marketplace access can reduce friction while maintaining revenue.

- Choosing the right metric is crucial—usage-based metrics can better align price with perceived value to minimize resistance and maximize growth potential and therefore should be explored, but you should not be beholden to usage-based pricing.

- Customer segmentation matters—not all API use cases are equal, and tailoring pricing based on customer use cases and willingness-to-pay ensures optimal monetization. Moreover, adjusting the per unit price of a suitable metric by segment or use case can make your model more effective without increasing complexity to the customer. (Read more about implicit metrics here).

API monetization isn’t just about setting a price—it’s about ensuring customers see the value while protecting margins and expansion potential. When done right, APIs can be one of the most powerful revenue levers in a SaaS business.